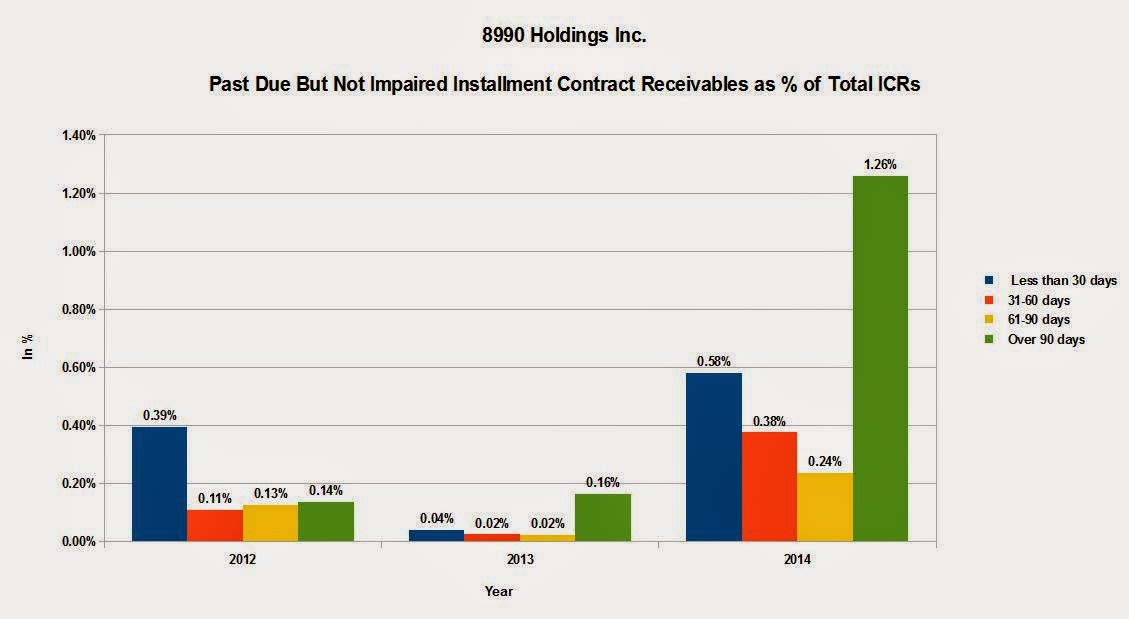

A few charts tell the story:

Total Past Due But Not Impaired ICRs now comprise 2.45% of 8990 Holdings Total ICR portfolio as of 2014, an exponential jump from 0.25% in 2013 and 0.77% reported in 2012.

This, by itself, is not worrying. What is worrying is that 8990 Holdings also reported a gargantuan hockey stick type increase in its Impaired ICRs, both in absolute value and relative to total ICRs.

So now we can see that both Past Due But Not Impaired ICRs as well as Impaired ICRs collectively comprise 12.29% of 8990 Holdings Total ICR portfolio of Php 14.113 billion as of December 31, 2014.

But what does this all mean?

Under 8990 Holdings' business model, the company functions like an in-house bank or mortgage lender, providing a substantial amount of financing to its customers so that these customers in turn can buy their homes. This model is great... when it works. For undertaking the risk of financing its customers, the company earns interest income from its customers over and above the gross profits it earns from the sale of a property. Under this model, the company owns the title to the properties it sells until the property is fully paid off, obviating the need for an expensive and protracted foreclosure process when a customer defaults.

Unlike a bank, 8990 Holdings has a higher cost of funds because not only does it borrow money from banks to finance the development of its properties, it also borrows money from banks to finance its loans to its customers, often by assigning its ICRs to a bank in exchange for ready cash. A bank has a much cheaper source of funding: its depositors who these days, are paid almost nothing for keeping their money in the bank. In order to earn a profit on its financing operations, the home financing provided by 8990 Holdings tends to be much more expensive than the home loans provided by banks. Also, the customers of 8990 Holdings tend to me much more marginal and less credit-worthy than bank customers. After all, why would anyone go to 8990 Holdings if they can get a much cheaper loan from a bank?

Has the company been to aggressive in its focus on sales to the point of sacrificing credit quality? Perhaps. Have home prices gone up so much past the point of affordability? Maybe. Have the company's customers been hit with an economic shock in the past year? If they have, it is not obvious because the nation's GDP grew at a decent 5.30% clip in 2014. But according to the Philippines Housing Land Use Regulatory Board (HLURB), there was a 16% drop in HLURB's Licenses to Sell in 2014 in the Socialized Housing space, 8990's market niche.

With 12.29% of its customers not paying off their properties on a timely basis means that as a bank, 8990 Holdings would rank as the 19th worst bank in the country in terms of Gross NPLs/Gross Total Loan Portfolio.

Around 80% of these past due borrowers are in severe default, hence the impaired status. In other words, these borrowers are in the process of being evicted from their homes and their homes repossessed by the company.

The company has already made provisions of Php 130.857 million for impairment losses and has recognized a loss of Php 56.972 million on property repossessions. Expect more to come as the "pig" of impaired ICRs" winds through the "python" of the company's eviction and repossession process.

See Previous Blog Posts:

Has the Philippine Real Estate Bubble Already Burst?

8990 Holdings, Inc.: The Case of the Disappearing Past Due Installment Contract Receivables

Has the Philippine Real Estate Bubble Already Burst?

8990 Holdings, Inc.: The Case of the Disappearing Past Due Installment Contract Receivables