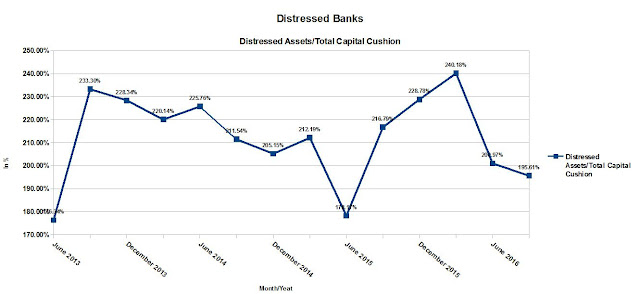

Editor's Note: The ratio of Distressed Assets to Total Capital Cushion is a variant of the famous Texas Ratio, which was widely used by US financial regulators to predict bank failure during the US Savings and Loan Crisis in the 1980s and early 1990s. The basic premise is that a bank with Distressed Assets greater than its Capital Cushion is in danger of insolvency because a significant drop in the value of the Distressed Assets will eat into a significant amount of the bank's capital. A bank that has a Distressed Ratio greater than 100% is flagged as borderline insolvent. For a more detailed discussion of this ratio, please visit a previous blog post: The Texas Ratio of Select Philippine Banks

This is a list of the top distressed Universal and Commercial (U/KB) as well as Thrift Banks in the Philippines as of September 30, 2016. It updates a previous blog post: "The Top Distressed Philippine Banks as of June 30, 2016".

This is a list of the top distressed Universal and Commercial (U/KB) as well as Thrift Banks in the Philippines as of September 30, 2016. It updates a previous blog post: "The Top Distressed Philippine Banks as of June 30, 2016".

To see where your bank stands relative to these banks, please check the previous blog post: "Philippine Banks Deteriorate Slightly in the 3rd Qtr of 2016".

| The Top Distressed Philippine Banks | |||

| Total Distressed Assets/ Total Capital Cushion | |||

| September 30, 2016 | |||

| In Php | |||

| September 30, 2016 | |||

| Bank | Total Distressed Assets (In PhP) | Total Capital Cushion (In PhP) | Distressed Assets/ Total Capital Cushion (In %) |

| VILLAGE BANK INC (A THRIFT BANK) | 612,421,717.03 | 98,494,178.93 | 621.78% |

| BANK OF CHINA LIMITED-MANILA BRANCH | 15,884,638,392.11 | 2,689,164,904.41 | 590.69% |

| INTER-ASIA DEVELOPMENT BANK | 212,979,011.00 | 60,584,384.65 | 351.54% |

| UNITED COCONUT PLANTERS BANK | 32,102,996,014.60 | 11,498,031,004.25 | 279.20% |

| PHIL POSTAL SAVINGS BANK INC | 2,644,058,195.81 | 1,391,970,544.82 | 189.95% |

| CITIBANK, N.A. | 28,176,037,619.07 | 18,852,261,103.84 | 149.46% |

| MALAYAN BANK SAVINGS AND MORT BANK INC | 1,705,740,200.89 | 1,180,703,393.55 | 144.47% |

| ENTERPRISE BANK INC (A THRIFT BANK) | 445,204,238.91 | 318,128,721.32 | 139.94% |

| LUZON DEVELOPMENT BANK | 947,553,825.59 | 681,879,488.39 | 138.96% |

| BPI GLOBE BANKO INC A SAVINGS BANK | 581,281,529.56 | 458,848,427.45 | 126.68% |

| CHINA BANK SAVINGS INC | 11,502,350,011.50 | 9,231,129,298.27 | 124.60% |

| PHILIPPINE RESOURCES SAVINGS BANKING CORPORATION (PR SAVINGS | 3,149,430,598.89 | 2,594,212,149.30 | 121.40% |

| EQUICOM SAVINGS BANK INC | 962,220,185.53 | 802,760,372.06 | 119.86% |

| BATAAN DEVELOPMENT BANK | 111,829,792.01 | 95,255,014.64 | 117.40% |

| OPPORTUNITY KAUSWAGAN BANK INC (A MICROFINANCE THRIFT BANK) | 167,435,912.01 | 154,721,453.56 | 108.22% |

| WORLD PARTNERS BANK (A THRIFT BANK) | 234,255,813.06 | 218,147,250.07 | 107.38% |

| LEGAZPI SAVINGS BANK INC | 920,117,253.90 | 882,809,874.96 | 104.23% |

| METRO CEBU PUBLIC SAVINGS BANK | 71,187,151.70 | 68,780,352.78 | 103.50% |

| FARMERS SAVINGS & LOAN BANK INC | 138,639,165.85 | 135,581,798.70 | 102.25% |

| Grand Total | 100,570,376,629.02 | 51,413,463,715.95 | 195.61% |

Source: www.bsp.gov.ph

Disclaimer:

This list only serves as a screening guide. It is not a definitive guide and must be taken in the context of other factors. The figures are based on the individual banks' statement of condition as of September 30, 2016 as published in the BSP website (www.bsp.gov.ph). For this analysis, no attempt was made to go through the audited financial statements of each bank. Readers are suggested to make their own investigations and verify the figures presented. Both BSP and PDIC have their own problem bank screening systems that are much more sophisticated in scope and design, given that they have more access to information over the banks they regulate.

This list only serves as a screening guide. It is not a definitive guide and must be taken in the context of other factors. The figures are based on the individual banks' statement of condition as of September 30, 2016 as published in the BSP website (www.bsp.gov.ph). For this analysis, no attempt was made to go through the audited financial statements of each bank. Readers are suggested to make their own investigations and verify the figures presented. Both BSP and PDIC have their own problem bank screening systems that are much more sophisticated in scope and design, given that they have more access to information over the banks they regulate.

No comments:

Post a Comment